Volume

2, Number 1, 2015, R5–R6 journal homepage:

region.ersa.org

Volume

2, Number 1, 2015, R5–R6 journal homepage:

region.ersa.orgPersonal income and its distribution in Spanish municipalities

1 Complutense University of Madrid, Madrid, Spain & GEN (Governance and Economic Research Network) (email: miriamhortas@ccee.ucm.es)2 Complutense University of Madrid, Madrid, Spain FEDEA & GEN (Governance and Economic Research Network) (email: jorge.onrubia@ccee.ucm.es) Received: 2 April 2015/Accepted: 2 April 2015

Abstract. This resource describes a data source for local personal income and its distribution in Spanish municipalities.

Key words: local income distribution, Personal Income Tax returns, income inequality, top incomes, Spanish municipalities

1 Description of the Resource

Local income data are an important economic indicator and widely used in a broad range of studies related to urban economics, fiscal federalism, housing, and spatial analysis, among others. In addition, aspects of income inequality and poverty at the local level are receiving increasing attention from researchers in these areas. Despite its importance, local income data remain a key missing element within the official statistics of many developed countries, with Spain being no exception. On one hand, the explanation lies in the complexity of designing surveys that are statistically reliable; on the other hand, it lies in the high cost of fieldwork, which requires carrying out a large number of interviews in all municipalities. As a result, most household income and expenditure surveys have a limited territorial representation, mainly at a regional or provincial level.

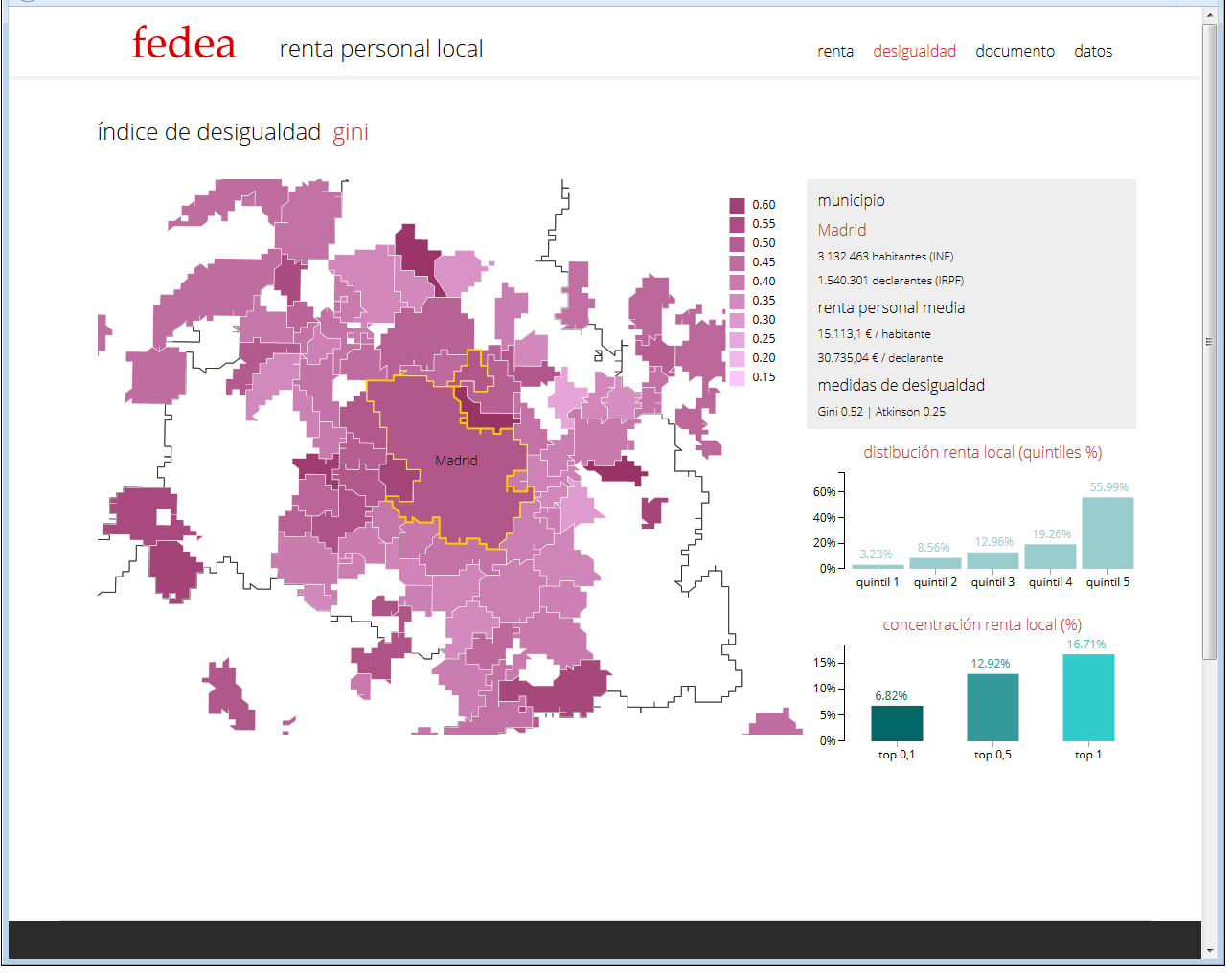

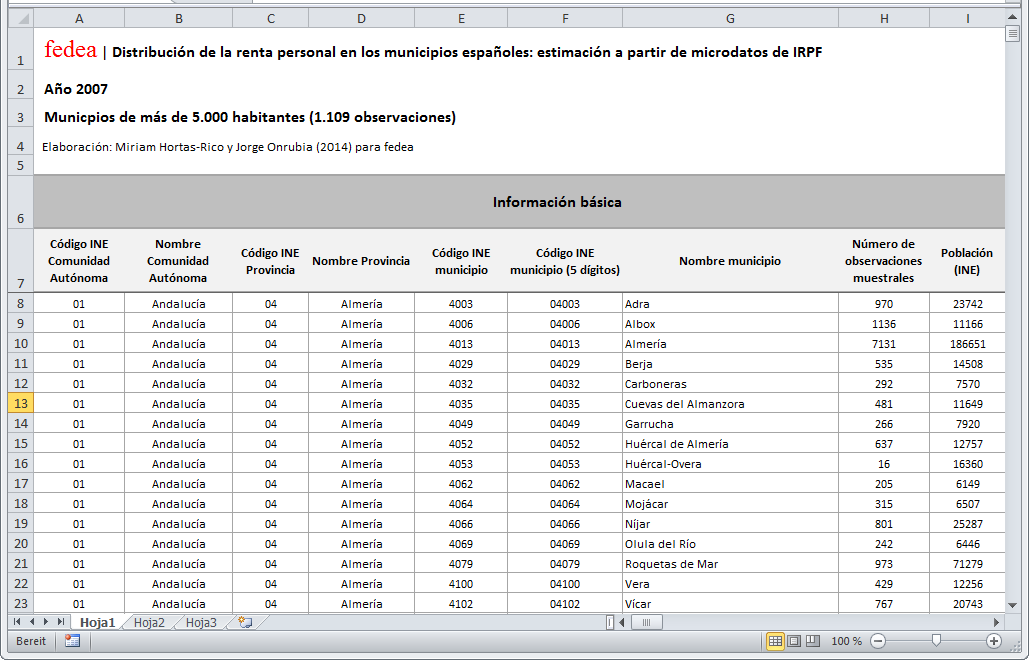

To address this lack of information, FEDEA presents a new database, “Local Personal Income and its distribution in Spain”, based on personal income tax (PIT) microdata provided by the Spanish Institute for Fiscal Studies in collaboration with the Spanish Tax Administration Office. These micro-level PIT samples are only representative at the provincial level and, therefore require implementing a reweighting procedure to derive a representative income sample at the municipal level (see Hortas-Rico et al. 2014 for more details). The methodology relies on a distance function optimization-based approach for survey reweighting, which consists of adjusting the original micro-data sample weights in order to make them representative at the local level. Then, local income distributions and selected summary measures are derived.

The database comprises Spanish municipalities with a population of more than 5,000 inhabitants that belong to the Autonomous Communities and Cities of “Common” Tax Regime (i.e. excluding the Basque Country and Navarre). For computational reasons, the database starts in 2007. Nonetheless, the aim is to update it regularly, covering the period 2000-2011. The next database release, which will cover the years 2002 and 2009, will be provided through the FEDEA website by the second half of 2015. For the years 2012 and onwards, information will be available as soon as official tax statistics are published.

For each year, the database provides unique data on personal income (per capita and per taxpayer income and median income) for each municipality. Information on local income distributions is summarized by means of quintiles. In addition, inequality measures (Gini and Atkinson 0.5 indexes), and a number of indicators of income concentration among top income earners are provided (top 1%, 0.5% and 0.1% income shares measures).

2 Resource link

References

Hortas-Rico M, Onrubia J, Pacifico D (2014) Estimating the personal income distribution in Spanish municipalities using tax micro-data. International Center for Public Policy Working Paper Series 1419, International Center for Public Policy, Andrew Young School of Policy Studies, Georgia State University